If you are a non-U.S. resident who earns income in the United States, you may need to apply for an Individual Taxpayer Identification Number (ITIN) to comply with U.S. tax laws. Starting a new job in the US or earning income as a non-US citizen can be exciting, but it can also be confusing when it comes to taxes. This is where the ITIN, or Individual Taxpayer Identification Number, comes in.

In this blog post, we will provide a comprehensive guide on ITINs, including what they are, how to obtain one, and why they are important.

What is an Individual Taxpayer Identification Number (ITIN)?

An ITIN is a tax processing number issued by the Internal Revenue Service (IRS) to individuals who are not eligible for a Social Security Number (SSN).

The Individual Taxpayer Identification Number (ITIN) was created by the Internal Revenue Service (IRS) in July 1996 to facilitate tax compliance for individuals who are not eligible for a Social Security Number (SSN). While ITINs are used for tax purposes, they are distinct from SSNs.

ITINs are nine-digit numbers that always begin with the number 9 and have a specific range of numbers for the fourth and fifth digits, including 50 to 65, 70 to 88, 90 to 92, and 94 to 99. ITINs are formatted like SSNs, with the format 9XX-XX-XXXX.

ITINs are commonly used by immigrants, including those who do not have lawful status in the United States, but who are required to pay taxes.

Additionally, foreign nationals who are legally residing in the United States, such as students, professors, or researchers, may obtain an ITIN if they are filing a U.S. tax return and are not eligible for an SSN. Spouses and dependents of U.S. citizens, lawful permanent residents, and dependents or spouses of foreign nationals on a temporary visa may also obtain an ITIN.

Who needs an ITIN?

Non-US citizens and resident aliens who have a tax filing requirement in the US but are not eligible for a Social Security number will need to obtain an ITIN.

This includes nonresident aliens, their spouses, and dependents who have US tax obligations but are not eligible for a Social Security number.

US resident aliens who do not qualify for a Social Security number but have a tax filing requirement may also need to obtain an ITIN.

It’s important to note that individuals should only apply for an ITIN if they have a specific need for one, as applying without a legitimate reason can result in penalties and interest on taxes owed.

Importance of ITIN

If you’re a non-US citizen or resident and earn income in the US, you may need to obtain an ITIN for various reasons. In this section, we will discuss the most common reasons for obtaining an ITIN and how it can benefit you. There are several reasons why obtaining an ITIN is important, including:

- Filing a U.S. tax return: One of the main reasons for obtaining an ITIN is to file a US tax return. Anyone who earns income in the US, regardless of their citizenship status, must file a tax return with the IRS. An ITIN serves as a taxpayer identification number, allowing non-US citizens and residents to comply with US tax laws.

- Claiming a tax treaty benefit: Non-US citizens and residents eligible for tax treaty benefits can use their ITIN to claim these benefits. Tax treaties between the US and other countries may reduce or eliminate the amount of taxes owed on certain types of income. By obtaining an ITIN, individuals can take advantage of these treaty benefits and potentially reduce their tax liability.

- Opening a U.S. bank account: Many US banks require a taxpayer identification number, such as an ITIN, to open an account. Without an ITIN, non-US citizens and residents may face difficulty opening a bank account, which can make it challenging to manage their finances and receive payments.

- Applying for a mortgage or loan in the U.S.: Non-US citizens and residents who want to purchase property or apply for a loan in the US may need an ITIN to do so. Many lenders require a taxpayer identification number as part of the application process. Without an ITIN, individuals may face challenges in securing a mortgage or loan, which can impact their ability to invest in US property or businesses.

By obtaining an ITIN, non-US citizens and residents can comply with US tax laws, take advantage of tax treaty benefits, open a US bank account, and apply for a mortgage or loan in the US. If you fall into any of these categories, it’s important to consider obtaining an ITIN to avoid potential financial and legal issues.

Recommended Blog: How the Chart of Accounts Works in QuickBooks

How to Obtain an ITIN

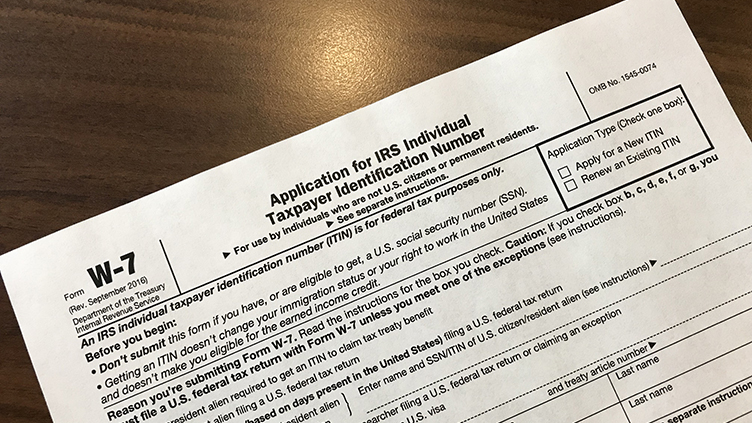

To obtain an ITIN, you will need to complete Form W-7 and submit it to the IRS along with the required documentation, such as a valid passport or other identifying documents. You can submit the application by mail or in person at an IRS Taxpayer Assistance Center.

Required Documentation for ITIN Application

The documentation required for an ITIN application includes:

- A completed Form W-7.

- A valid federal income tax return, unless you qualify for an exception.

- Identification documents, such as a valid passport, driver’s license, or other identifying documents.

After completing Form W-7 and gathering the required documentation, you can submit the application to the IRS by mail or in person at an IRS Taxpayer Assistance Center. The IRS will review your application and notify you of your ITIN status.

The processing time for an ITIN application can vary depending on the time of year and volume of applications.

Generally, it takes around 7 weeks for the IRS to process an ITIN application submitted by mail. However, you can expedite the process by submitting the application personally at an IRS Taxpayer Assistance Center.

Renewing and Maintaining an ITIN

ITINs expire after a certain period of time, depending on when they were issued. To renew your ITIN, you must submit a new Form W-7, along with the required documentation.

You should start the renewal process at least 45 days before your ITIN is set to expire.

Additionally, if your information changes or becomes inaccurate, you must notify the IRS to maintain the accuracy of your ITIN.

For more valuable insights on similar topics, please check out my other blog posts: 10 Tips for Managing Your Finances with QuickBooks

ITIN Revocation and Cancellation

The IRS may revoke or cancel your ITIN if it is discovered that the information you provided on your application was incorrect or if you no longer need the ITIN.

This could happen if you become eligible to obtain a Social Security Number (SSN) or if you fail to file tax returns for three consecutive years.

It is important to keep the information on your ITIN application up-to-date. If any of your personal information changes, such as your name or mailing address, you must notify the IRS within 60 days. Failure to do so could result in delays or errors with your tax returns or other IRS communications.

Obtaining an ITIN is an important step for non-U.S. residents who earn income in the United States. It allows you to comply with U.S. tax laws and take advantage of certain benefits, such as opening a U.S. bank account or applying for a loan.

Remember to keep your ITIN information up to date and renew it as necessary to remain in compliance with U.S. tax laws.

For More such Insightful helpful content, do join us on our Instagram Page-Edueasify. Get the Latest Information on Business, Finance, Investment, Brand Building, Lifestyle, Entertainment, and Billionaire Quotes On Edueasify.