Mortgage Discount Points: Are you keen on optimizing your tax savings while realizing your dream of homeownership? Let’s explore a lesser-known deduction available for homeowners: Mortgage Discount Points.

What are Mortgage Discount Points?

Mortgage Discount Points entail paying an upfront sum to receive points, which results in a reduction in the interest rate on your home loan.

Mortgage discount points are a form of prepaid interest that a borrower can choose to pay upfront at the time of closing on a mortgage loan.

Each point typically costs 1% of the total loan amount and can lower the interest rate on the mortgage by a certain amount, usually 0.25% per point, although this can vary depending on the lender and the terms of the loan.

Check: Comparing Today’s Mortgage Rates: Find Your Best Deal Now!

Homebuyer’s Secret Weapon: Slash Rates & Taxes with Mortgage Discount Points

How Does it Work?

You’re taking out a $100,000 loan for 20 years with a 5.5% interest rate. Your lender offers you the option to purchase 2 mortgage points at $1500 each. By doing so, your mortgage interest rate decreases by 0.75%.

Illustrative Example:

| Scenario | Without Points | With Points |

|---|---|---|

| Loan Amount | $100,000 | $100,000 |

| Interest Rate | 5.5% | 4.75% |

| Total Cost | $165,094 | $158,093 |

| Points Paid | $0 | $3,000 |

| Savings | – | $7,001 |

Without purchasing points, the total cost over 20 years amounts to $165,094. However, with mortgage points, the total cost becomes $158,093 (plus $3000 upfront for points), resulting in a saving of $7001 (excluding the time value).

Read: Maximizing Your Energy Efficient Home Improvement Credit: The Power of Product Identification Numbers (PINs), 13 Essential Additional Expenses When Buying a Home

Tax Benefits: Deducting Mortgage Discount Points on Your Taxes

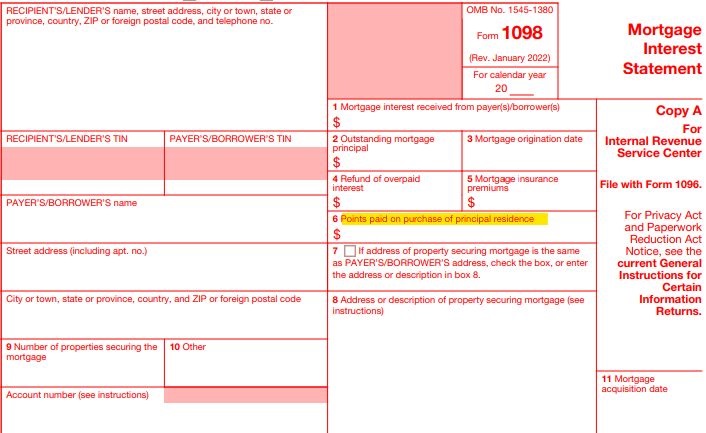

According to the IRS, the upfront payment for points is considered a prepayment of interest. Hence, taxpayers can claim a deduction for this amount on their Schedule A of Form 1040, provided the property is their principal residence.

In conclusion, by strategically utilizing Mortgage Discount Points, homeowners can secure a more favorable interest rate and maximize their tax deductions, leading to substantial long-term savings.

See: Commercial Mortgage Investing: A Guide for Beginners

Get live Tax and Finance updates, US Business Tax and Bookkeeping, and the latest India & US News and business news on Edueasify.