If you’re engaged in farming, whether as a small-scale grower or a large-scale agricultural producer, reporting your farming income and farming expenses accurately is very important.

The IRS requires farmers to file Form 1040 Schedule F to report their profit or loss from farming. Understanding agricultural taxes and using proper farm tax preparation strategies can help you minimize your tax burden and maximize deductions.

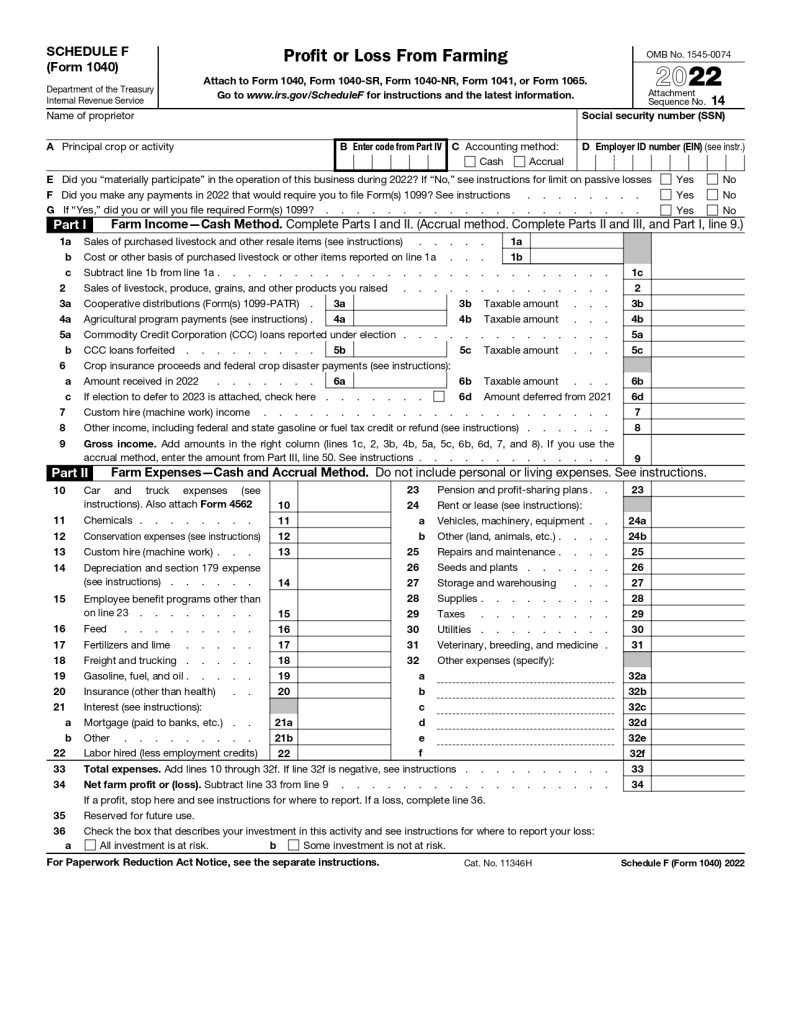

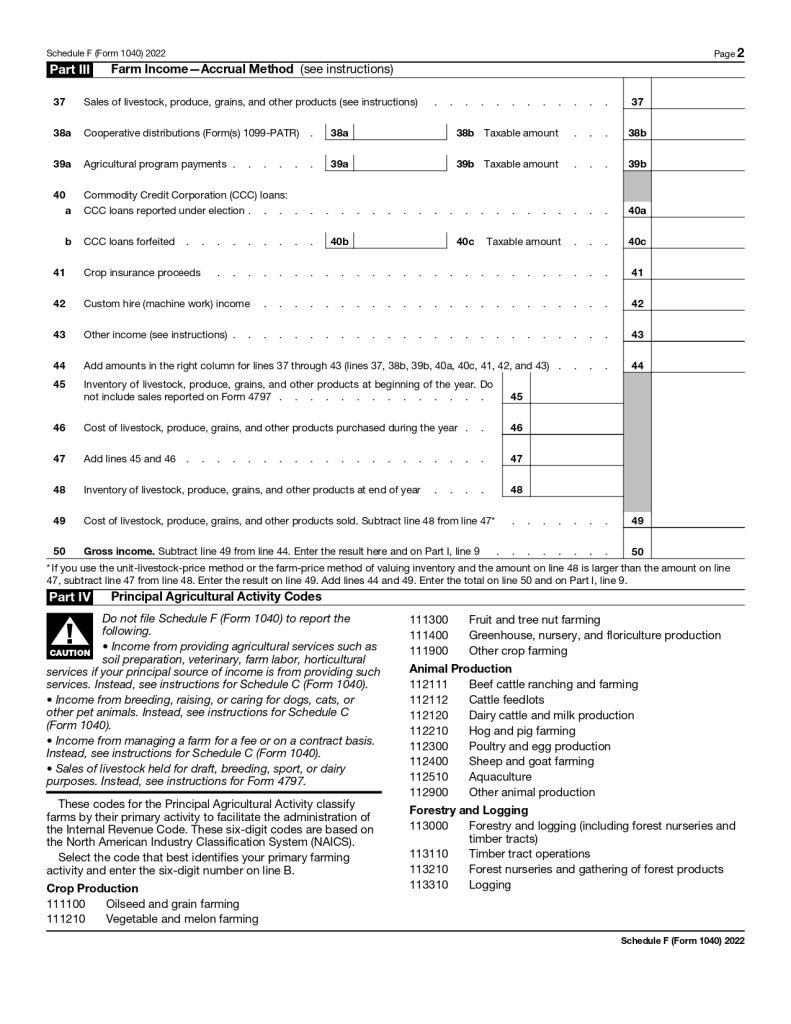

What is Schedule F (Form 1040)?

Schedule F (Form 1040) is used by farmers to report gross farm income, net farm profit/loss, and claim farm tax deductions on qualified expenses.

This form applies to sole proprietors and certain partnerships engaged in farming activities

Who Needs to File IRS Schedule F?

You must file IRS Schedule F if you:

- Earn income from farming operations, including livestock, crops, and other agricultural activities.

- Incur operating expenses (farm) to sustain your agricultural business.

- Are self-employed and need to calculate self-employment tax (for farmers).

- Want to claim tax benefits such as farm tax credits and depreciation (farm assets).

Key Components of Farm Taxes

Understanding farm taxes involves multiple aspects, including income reporting, expense tracking, deductions, and credits. Below are the core elements:

1. Farm Income Reporting

Gross farm income includes revenue from various sources such as:

- Crop sales

- Livestock sales

- Government program payments

- Crop insurance proceeds

- Custom hire or machine work

2. Farm Expense Tracking and Deductions

To lower taxable income, farmers can deduct several farming expenses:

- Depreciation (farm assets): Tractors, barns, and equipment.

- Operating expenses (farm): Seeds, fertilizers, pesticides, and fuel.

- Interest on farm loans: Interest paid on business-related loans.

- Insurance premiums: Crop insurance and liability insurance.

- Wages and salaries: Payments to farm workers and laborers.

| Deductible Farm Expense | Description |

|---|---|

| Equipment Depreciation | Tractors, machines, tools |

| Livestock Feed | Hay, grain, and other livestock feed |

| Farm Utilities | Electricity, water, and gas for farm use |

| Repairs & Maintenance | Fixing farm buildings, fences, and machinery |

| Seed & Fertilizer | Inputs required for planting |

How to Fill Out Schedule F (Form 1040)?

- Identify Farm Income: List all income sources from your farming operations.

- Categorize Farm Expenses: Record deductible farm tax deductions based on IRS guidelines.

- Calculate Net Profit or Loss: Subtract expenses from income to determine your net farm profit/loss.

- Complete Self-Employment Tax Section: If applicable, calculate your self-employment tax (for farmers).

- File Along with Form 1040: Attach Form 1040 Schedule F to your tax return.

Common Mistakes on Schedule F

Filing errors can lead to audits or penalties. Avoid these common mistakes:

- Incorrect income reporting: Ensure all farm-related revenue is accurately reported.

- Missing deductions: Farmers often overlook eligible farm tax deductions.

- Improper depreciation claims: Follow IRS guidelines for depreciation (farm assets).

- Mixing personal and farm expenses: Keep farm accounts separate from personal finances.

- 401(k) limit increases to $23,500 for 2025, IRA limit remains $7,000

- Form 8990: Limitation on deduction for Business Interest Expense

- LLC Pass-Through Taxation: Key Lessons from a Recent Tax Court Case

- IRS Tax Tips: Emergencies, Disaster Relief, and Protecting Your Financial Records

- 7 Red Flags that Could Trigger an IRS Audit

- New IRS Regulations Enable Tax Credit Transfers under IRA

- Reporting of Beneficial Ownership Information for U.S. Companies to FinCEN

- Wyoming Sales Tax

- Annual Mandatory Compliances for LLC

- Child Tax Credit 2024

- IRS Tax Refunds

Tips for Reducing Farm Tax Burden

To lower your tax liability, consider these strategies:

- Use proper farm accounting: Maintain detailed records of farm income reporting and farm expense tracking.

- Take advantage of tax credits: Research available farm tax credits.

- Plan ahead for depreciation: Utilize IRS-approved depreciation (farm assets) methods.

- Consider hobby farming rules: Know the difference between a hobby farming (vs. business) operation to avoid IRS scrutiny.

Best Way to Organize Farm Tax Records

Good bookkeeping is essential for accurate tax filing. Use:

- Farm tax software to automate calculations.

- Spreadsheets for income and expense tracking.

- Cloud storage to save digital receipts and invoices.

Farm Tax Checklist for a Smooth Filing Process

Use this farm tax checklist to stay organized.

✅ Collect all farm income reporting documents.

✅ Categorize farming expenses and calculate deductions.

✅ Verify self-employment tax (for farmers) obligations.

✅ Review IRS guidelines for agricultural taxes.

✅ File Form 1040 Schedule F accurately and on time.

Where to Find Schedule F Instructions?

You can find official Schedule F (Form 1040) instructions on the IRS website or consult a tax professional for personalized advice.

To download Schedule F, simply click on the link provided below. Download Schedule F Form

In summary, Schedule F serves as an indispensable component of Form 1040 for individuals involved in farming and ranching.

Understanding Schedule F (Form 1040) and applying strategic farm tax preparation can help you optimize tax benefits while staying compliant with IRS regulations. Whether you run a small farm taxes operation or a large-scale agricultural business, meticulous record-keeping and proactive planning will ensure smooth tax filing.

Get the Latest Financial News, Expert Insights, Trends, and Tips you need to make Informed Decisions about your Business, Taxes, and Investments at edueasify.