IRS Raises 401(k) Contribution Limits for 2024: The Internal Revenue Service (IRS) has declared an increase in the annual 401(K) Contribution Limits for 2024 for individuals participating in 401(k) retirement plans for the year 2024.

Effective from the Financial Year 2024, Employee’s will have the opportunity to contribute a maximum of $23,000 to their 401(k) plans, marking a notable increase from the previous limit of $22,500 set for the year 2023.

The contribution limit for employees participating in 401(k), 403(b), and most 457 plans, along with the federal government’s Thrift Savings Plan, has been raised to $23,000, up from $22,500.

What is 401K?

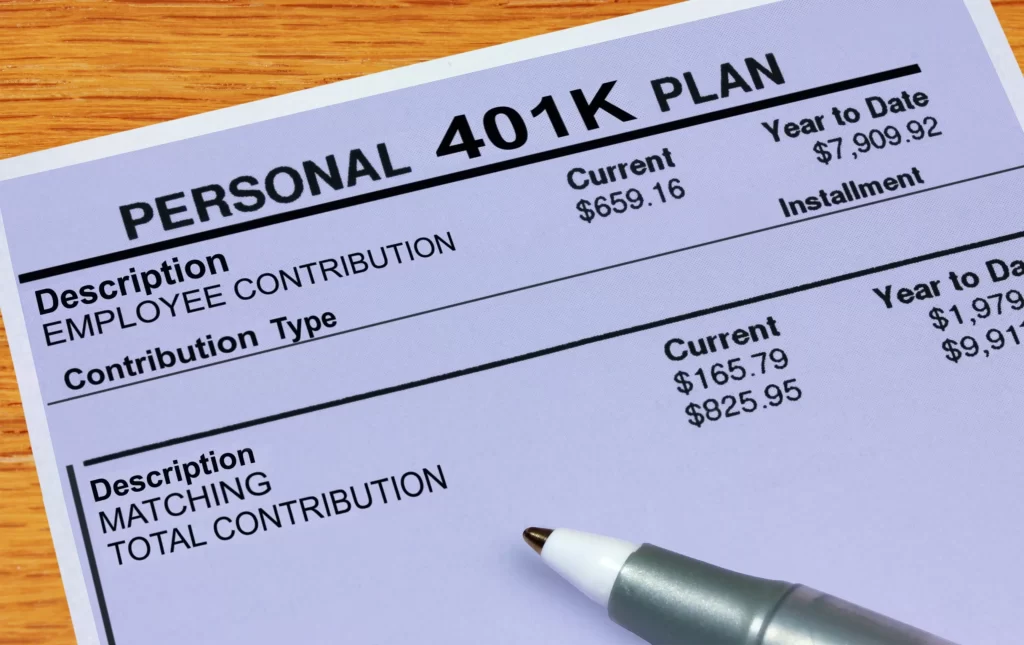

A 401(k) is a type of retirement savings plan in the United States, established by employers for their employees.

Employee is allows to contribute a portion of their earning into an 401(k) Retirement Investment account. In Contra, Employer are also contribute some match portion in whole or in part.

The funds accumulated in in a 401(k) account can be invested in various financial instruments such as stocks, bonds, and mutual funds. Which help US Government in providing employees with the potential for long-term growth.

If Employee wants to Withdraw money from 401(k) which are typically made in retirement and are subject to taxation.

401(k) retirement savings vehicle is widely used as a key component of retirement planning for many working individuals in the United States.

Read: Secure Your Future: Why Investment is the Key to Financial Stability

401(K) Contribution Limits for 2024

The 401(k) contribution limit has risen by $500, from $22,500 in 2023 to $23,000 in 2024, indicating a more modest increase compared to the previous year.

This adjustment is particularly beneficial for savers under the age of 50, encouraging positive steps towards investing in their 401(k) plans.

Lets understand the changes made by IRS in 401K Contribution Limits for 2024 in table form. Here you can Check how much employee can contribute to 401k in 2024

| Retirement Plan or Contribution Type | 2023 Limit | 2024 Limit | Notes |

|---|---|---|---|

| 401(k), 403(b), 457 Plans, and Thrift Savings Plan | $22,500 | $23,000 | Contribution limit increased by $500. |

| Traditional IRA Contribution Limit | $6,500 | $7,000 | Annual contribution limit raised by $500. |

| IRA Catch-up Contribution Limit (Age 50 and over) | $1,000 | $1,000 | Remains unchanged for 2024. |

| Catch-up Contribution Limit for 401(k), 403(b), 457 Plans, and Thrift Savings Plan (Age 50 and over) | $7,500 | $7,500 | No change for 2024. Total contribution limit for 50 and older is $30,500. |

| Catch-up Contribution Limit for SIMPLE Plans (Age 50 and over) | $3,500 | $3,500 | Remains unchanged for 2024. |

| Income Ranges for Deductible Contributions, Roth Contributions, and Saver’s Credit | Various | Adjusted for 2024 | Income thresholds increased for eligibility. |

| SIMPLE Retirement Account Contribution Limit | $15,500 | $16,000 | Contribution limit increased by $500. |

| Qualifying Longevity Annuity Contract Premium Limit | $200,000 | $200,000 | No change for 2024. |

| Charitable Distributions Deductible Limit | $100,000 | $105,000 | Increased by $5,000 for 2024. |

| One-Time Election to Treat Distribution to Split-Interest Entity Deductible Limit | $50,000 | $53,000 | Increased by $3,000 for 2024. |

401(k) Withdrawals: Penalties & Rules for Cashing Out a 401(k)

Withdrawing money from a 401(k) typically triggers tax implications. However, there are certain situations where you can avoid taxes or penalties on your withdrawals.

Here are the main conditions for tax-free 401(k) withdrawals:

01. Age

59 ½ or older: Reaching this age is the most common tax-free withdrawal condition. Once you turn 59 ½, you can withdraw any amount from your 401(k) without owing income tax or the 10% early withdrawal penalty.

02. Disability

If you become disabled before reaching age 59 ½, you may qualify for tax-free and penalty-free withdrawals from your 401(k). You’ll need to provide documentation from a doctor certifying your disability.

03. Death

In the unfortunate event of the account owner’s death, beneficiaries can inherit the 401(k) without owing taxes or penalties. Spouses can roll the funds into their own IRA, while other beneficiaries may have different options depending on the plan and their relationship to the deceased.

04. Qualified medical expenses

You can withdraw money from your 401(k) to cover unreimbursed medical expenses for yourself, your spouse, or your dependents. These expenses must exceed 7.5% of your adjusted gross income for the year.

05. Hardship withdrawals

In limited circumstances, you may be eligible for a hardship withdrawal from your 401(k) without paying the 10% penalty. These circumstances typically involve severe financial hardship, such as preventing foreclosure on your home or paying for necessary medical care. However, you’ll still owe income tax on the withdrawn amount.

What is the 401(k) early withdrawal penalty?

Withdrawing money from your 401(k) before the age of 59 ½ can come with some hefty consequences, primarily the 10% early withdrawal penalty imposed by the IRS.

If an individual withdraws money from their 401(k) prematurely, for example, a $10,000 withdrawal, they may be subject to a $1,000 early distribution penalty in addition to the regular income tax owed on the withdrawn amount.

Let’s breakdown of what that means in example:

- Withdrawal amount: $10,000

- Early withdrawal penalty (10%): $1,000

- Total amount taken by penalty and taxes (assuming your tax bracket): $3,200 ($1,000 penalty + $2,200 income tax)

- Take-home amount: $6,800 ($10,000 – $3,200)

If you enjoy our blog on ‘401(k) Contribution Limits for 2024,’ please share it with your friends!

Visit: Step-by-Step Guide: Starting an LLC in Dubai as an Indian Entrepreneur

For More such Insightful helpful content, do join us on our Instagram Page-Edueasify. Get the Latest Information on Business, Finance, Investment, Brand Building, Lifestyle, Entertainment, and Billionaire Quotes On Edueasify.