Turnover Calculation for F&O & Intraday Trading: The Futures and Options (F&O) market in India is like a big playground for investors who want to explore more ways to invest in stocks. But when it comes to figuring out how much money you’ve made and how much tax you owe on it, things can get a bit confusing. That’s where understanding how to “Calculate Turnover for F&O Trading” comes in handy.

In this blog, I’ll explain you How to Calculate Turnover for F&O Trading in easy-to-understand terms, so everyone can grasp it, whether you’re new to the F&O Trading or have been at it for a while.

What is F&O Turnover?

Navigating Futures and Options (F&O) trading can feel like wandering through a maze, especially when it comes to understanding F&O turnover. But don’t worry! As a Chartered Accountant, I’m here to simplify things and help you understand to Calculate Turnover for F&O Trading, so you can trade with confidence.

In essence, F&O turnover reflects the total income generated from your F&O trading activities. It’s a crucial metric that encompasses both your profits and losses.

However, before we delve deeper, it’s important to learn the fundamental principle of F&O Trading. Income Tax Department consider F&O trading as Business Income. It means any profits you accrue being categorized as business income and subject to taxation accordingly.

Calculating F&O Turnover: A Step-by-Step Guide

Now, let’s address the burning question: how do you calculate F&O turnover? It’s essentially a two-step process:

- Total F&O Trading Income: Begin by determining your gross income from F&O trades. This includes all profits earned.

- Subtracting Trading Expenses: From your gross income, deduct all the expenses incurred while executing your F&O trades. These expenses can includes:

- Brokerage commissions: The fees levied by your broker for facilitating your trades.

- Rent for your trading space: If you have a dedicated space for F&O activities, factor in the rent as an expense.

- Other business expenses: Any other legitimate business expense associated with your F&O trading can be included here.

The resulting figure after subtracting your expenses from the gross income represents your F&O turnover. It can be positive, indicating that your profits outweighed the expenses, or negative, signifying that your losses surpassed the profits.

Why Understanding F&O Turnover is Important?

Comprehending F&O turnover holds immense significance for two primary reasons:

- Tax Compliance: Knowing your F&O turnover is paramount for ensuring you fulfill your tax obligations accurately. It forms the basis for calculating the taxable income from your F&O activities.

- Effective Trade Management: By tracking your F&O turnover, you gain valuable insights into the overall performance of your trading strategies. This empowers you to make informed decisions, identify areas for improvement, and optimize your F&O trading journey.

How to Calculate F&O Turnover

To calculate turnover for F&O trading, follow these steps:

- Firstly, Start considering both positive and negative differences into account while calculating F&O Turnover.

- Make sure to include the premium received by the trader when selling options.

- Additionally, if a trader reverses a trade, include the difference afterward in the F&O turnover calculation.

Future turnover is calculated as the absolute profit, which is the sum of profit and loss from all transactions conducted throughout the Financial year. Absolute profit refers to the aggregate of favorable and unfavorable differences.

Future turnover = Sum of (all Profits + all Losses) on futures trades

In the 8th edition of the Guidance Notes issued by the Institute of Chartered Accountants of India (ICAI), a significant change has been introduced regarding the calculation of turnover for options traders.

Previously, under the 7th edition, the premium received on the sale of options was required to be include to Calculate Turnover for F&O Trading. However, the new guidance note, released in August 2022, simplifies this process. It states that if the premium received has already been accounted for in the calculation of net profit, it does not need to be included separately in the F&O turnover calculation.

Therefore, according to the updated guidance, the absolute profit serves as the turnover for options trading. Despite this change, the conditions for Tax Audit remain unchanged.

F&O Turnover = Absolute Profit

Intraday and F&O Trade come under Tax Audit implications if the “TURNOVER” goes beyond the prescribed limit of Rs. 10 Crores.

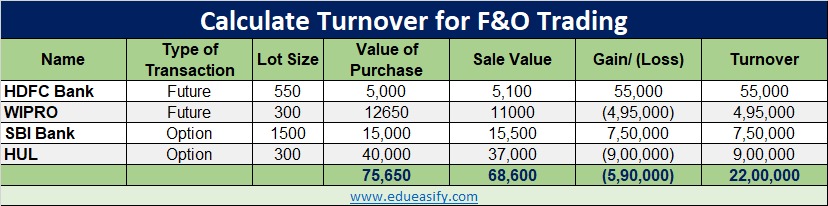

Example to Calculate Turnover for F&O Trading

To determine your F&O (Futures & Options) turnover, it’s necessary to consider all your transaction made in F&O Trading throughout a financial year. This includes:

- Profitable Transactions: Any trades where you sold an asset for more than you bought it.

- Unprofitable Transactions: Any trades where you sold an asset for less than you bought it.

The following example demonstrates How to Calculate Turnover for F&O Trading based on both profitable and unprofitable trades:

📢 Read More: New Tax Regime vs. Old Tax Regime: Which One Saves You More Tax in AY 2024-25?

Tax Implications: Delivery Based vs. Intraday & F&O Trading

In recent years, many people have been participating in Intraday and Futures & Options Trading (F&O) in the share market. It’s crucial to understand that the tax treatment for these trades is entirely different from that of Delivery Based Shares.

- Delivery-Based Shares: These are treated as capital assets. Profits from holding these shares for more than a year (long-term) are subject to long-term capital gains tax, which can be tax-free up to a limit of Rs. 100000 and then taxed at a lower rate compared to regular income. Conversely, profits from holding them for less than a year (short-term) are taxed as short-term capital gains at your regular income tax rate.

- Intraday and F&O Trading: These are considered business income. Profits from these trades are taxed at your regular income tax slab rate, which can go up to 30% depending on your income level. This is because these trades are seen as frequent buying and selling with the intention of making short-term profits, similar to a business activity.

Tax Audit Implications

For individuals with high trading volumes, tax audit considerations come into play. If your F&O turnover exceeds Rs. 10 Crores in a financial year, it becomes mandatory to get a tax audit conducted.

How to Show Intraday and F&O Trading Income in ITR?

It is very important to declared a correct income from Intraday and F&O Trading in ITR.

Intraday Income

Income from Intraday Trading is considered as Speculative Business Income. Therefore, if there are losses under Intraday Trading, it cannot be merged with ANY other income.

However, Intraday Losses can be carried forward for the next 4 Assessment Years.

F&O Income

Income from F&O Trading is considered as Non-Speculative Business Income. Therefore, it becomes normal business income (like any other business).

If there are losses under F&O, that can be set off against any other Income (excluding Salary and Special Rate Incomes).

Losses remaining after set-off can be carried forward for the next 8 Assessment years.

Tax Treatment of Intraday and F&O Trading

| Feature | Intraday Trading | F&O Trading (Excluding Intraday) |

|---|---|---|

| Tax Treatment | Speculative Business Income | Non-Speculative Business Income |

| Profits | Taxed at income tax slab rate (up to 30%) | Taxed at income tax slab rate (up to 30%) |

| Losses | Cannot be offset against other income sources | Can be set off against any other income (excluding salary and special rate incomes) |

| Carry Forward of Losses | Up to 4 subsequent assessment years | Up to 8 subsequent assessment years (if losses exceed non-speculative business income) |

If you’re considering starting Intraday and F&O Trading, it’s essential to have a Demat Account. Open a free Demat Account online in just 5 minutes with Angel One by clicking on the link provided: https://tinyurl.com/29t8ysm9

Get the Latest Financial News, Expert Insights, Trends, and Tips you need to make Informed Decisions about your Business, Taxes, and Investments at edueasify.