Great news for organizations that help low-income taxpayers! The Internal Revenue Service (IRS) is accepting applications for Low Income Taxpayer Clinics (LITC) matching grants. These grants provide crucial funding for organizations that offer free Tax Help or low-cost tax assistance to those who need it most.

What is a Low-Income Taxpayer Clinics (LITCs)?

Low-Income Taxpayer Clinics (LITCs) are organizations that provide free or low-cost legal assistance to low-income individuals who are facing tax problems with the Internal Revenue Service (IRS). They are completely independent of the IRS, ensuring unbiased representation.

Here’s a breakdown of what LITCs do:

- Representation: LITCs can represent you in various tax disputes with the IRS, including audits, appeals, and tax collection issues. They can even advocate for you in court if necessary.

- Guidance: If you’ve received a confusing notice from the IRS, LITCs can help you understand it and formulate a proper response.

- Account Resolution: Are you struggling with errors in your IRS account? LITCs can assist you in getting things straightened out.

- Education: LITCs offer educational resources and outreach programs, particularly for individuals who speak English as a second language (ESL). This empowers taxpayers to understand their rights and responsibilities.

Who Qualifies for LITCs Help?

- Individuals and families with low income

- Taxpayers for whom English is a second language (ESL)

What Services Do Low Income Taxpayer Clinic (LITCs) Offer?

LITCs play a vital role in ensuring fairness within the tax system for low-income taxpayers. They offer a variety of services including:

- Free tax representation: LITCs can help you resolve tax disputes with the IRS.

- Tax education: LITCs can educate ESL taxpayers about their tax rights and responsibilities.

- Advocacy: LITCs can identify and advocate for issues that impact low-income and ESL taxpayers.

Low Income Taxpayer Clinic Grants Application Details

| Particulars | Low Income Taxpayer Clinic Grants Details |

| Eligibility for LITCs Grants | Organizations must meet IRS criteria outlined in IRS Publication 3319 |

| Application Period | April 22, 2024 – June 12, 2024 |

| Grant Period | January 1, 2025 – December 31, 2025 |

| Maximum per-clinic funding | $28 million (FY 2024) with potential reduction to $26 million (FY 2025) |

| Maximum per-clinic funding | $200,000 per clinic |

How to Apply for Help Low Income Taxpayer Clinic Grants

You cannot apply for help directly through the IRS grant program. However, the IRS is encouraging organizations in underserved areas to apply to become LITCs.

You can find a list of underserved areas in the press release. If you are a low-income taxpayer or ESL taxpayer who needs help, contact your local tax advocacy organization or legal aid office to see if they offer free tax services.Low-Income Taxpayers and the 90/250 RequirementYou can find a list of underserved areas in the press release. If you are a low-income taxpayer or ESL taxpayer who needs help, contact your local tax advocacy organization or legal aid office to see if they offer free tax services.

Low-Income Taxpayer Clinics (LITCs) and the 90/250 Requirement

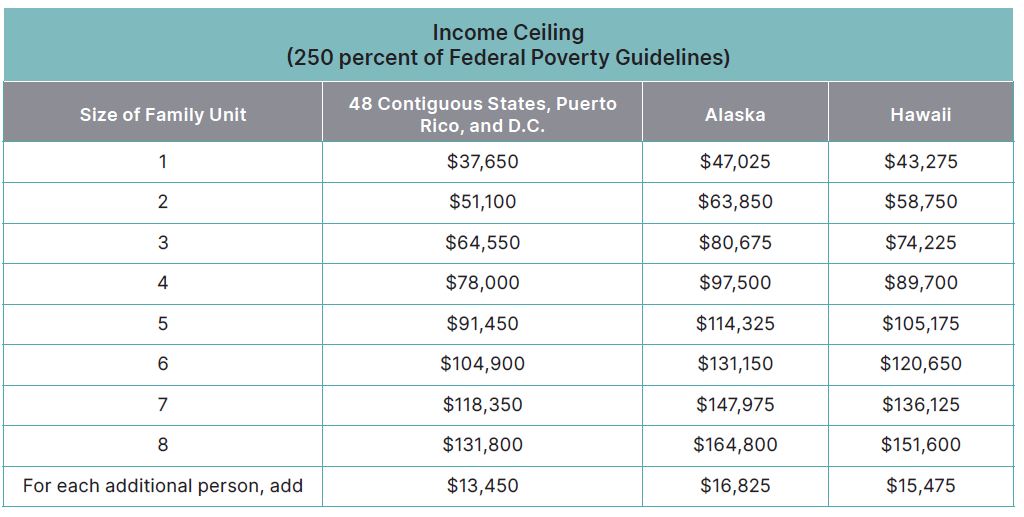

The Internal Revenue Code (IRC) requires that Low-Income Taxpayer Clinics (LITCs) primarily serve low-income taxpayers. To qualify for funding, an LITC must represent taxpayers whose income falls at or below a certain threshold.

90/250 Rule forLITC

- At least 90% of the taxpayers an LITC represents in controversy cases must have incomes that don’t exceed 250% of the Federal Poverty Level.

- This rule doesn’t apply to consultations or other LITC services.

Federal Poverty Guidelines – LITC Income Guidelines

- The Department of Health and Human Services (HHS) publishes annual Federal Poverty Guidelines, which LITC programs use to determine income eligibility.

- The LITC Program Office updates its income guidelines based on these annually.

- Reporting of Beneficial Ownership Information for U.S. Companies to FinCEN

- Wyoming Sales Tax: A Simple Guide for Businesses and Individuals

- Annual Mandatory Compliances for LLC

- Child Tax Credit 2024

- IRS Tax Refunds

- 1% Stock Buyback Tax: New IRS Guidance for Corporations

Form 13424-Low Income Taxpayer Clinic Application Information

How can I find a Low Income Taxpayer clinic?

You can find the Low Income Taxpayer clinic at the Taxpayer Advocate Service Portal.

Get the Latest Financial News, Expert Insights, Trends, and Tips you need to make Informed Decisions about your Business, Taxes, and Investments at edueasify.