Form 8990 is a crucial IRS form that helps businesses to calculate their interest expense deductions under the Tax Cuts and Jobs Act (TCJA). It’s essential for businesses with significant Business interest expense to understand how this limitation works, as it can impact their tax liability. In this article, we’ll break down the basics of Form 8990 and the business interest expense limitation to help you understand the process with ease.

What is Form 8990?

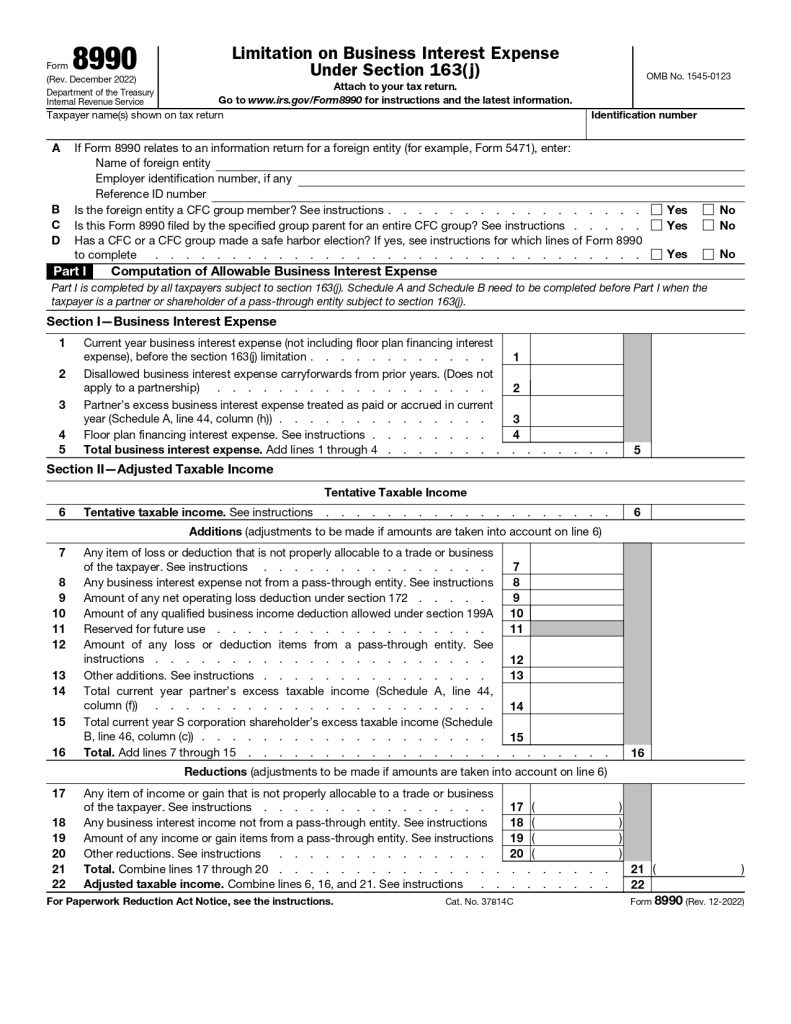

Form 8990, Limitation on Business Interest Expense Under Section 163(j), is a crucial document for taxpayers looking to deduct business interest expenses.

The form is primarily used to compute and report any limitations on the deduction of business interest expenses, as defined under Section 163(j) of the Internal Revenue Code (IRC).

This provision limits the amount of interest expense that businesses can deduct each year, which can significantly impact financial planning and tax obligations.

What is the Section 163(j) Limitation on Business Interest Expense?

The Section 163(j) limitation restricts the amount of deductible business interest expense to the sum of:

- Business interest income for the taxable year,

- 30% of the taxpayer’s adjusted taxable income (ATI) for the taxable year, and

- Floor plan financing interest expense for the taxable year.

This limitation aims to prevent businesses from deducting excessive interest expenses. Notably, the CARES Act introduced temporary modifications, allowing a 50% ATI limit for the taxable years 2019 and 2020.

Let’s understand by one example,

Edueasify LLC has $200,000 in gross income and incurs $60,000 in business interest expense.

- If Edueasify LLC’s Adjusted Taxable Income (ATI) is $180,000, it can deduct up to $54,000 of its interest expense (which is 30% of the ATI).

- The remaining $6,000 in interest expense that cannot be deducted in the current year is carried forward to future years. In those years, Edueasify LLC can use this carried-forward interest to potentially reduce its taxable income, depending on future limitations.

Who is Subject to the Section 163(j) Limitation?

The Section 163(j) limitation generally applies to most taxpayers with business interest expenses, except for certain small businesses that meet the gross receipts test under Section 448(c).

Businesses with average annual gross receipts of $27 million or less over the past three years may qualify as “exempt small businesses” and avoid this limitation.

Certain electing real property trades or businesses, farming businesses, and other excepted trades or businesses may also be exempt.

Eligibility Criteria for Exemption from Section 163(j) Limitation

Gross Receipts Test: Qualifying as an Exempt Small Business

To be exempt from the Section 163(j) limitation, a business must pass the gross receipts test. This means the business:

- Is not classified as a tax shelter,

- Has average annual gross receipts of $25 million or less over the preceding three years, adjusted annually for inflation (e.g., $27 million for 2022).

Even if a business previously exceeded the threshold, a reduction in gross receipts in subsequent years could make it eligible for exemption.

For example, a business that exceeded $26 million in average receipts during 2018-2020 could become exempt in 2022 if its average receipts from 2019-2021 dropped below $27 million.

Excepted Trades or Businesses

Certain trades or businesses can elect to be treated as excepted trades or businesses, such as:

- Real property trades or businesses (e.g., real estate operations),

- Farming businesses, and

- Certain regulated utility businesses.

To make this election, taxpayers must attach a statement to their federal income tax return, providing specific details about the business and its activities. This election, once made, is generally irrevocable and impacts the depreciation method used for assets in these businesses.

How to Calculate Adjusted Taxable Income (ATI)

Adjusted Taxable Income (ATI) is crucial for determining the Section 163(j) limitation. ATI is calculated by adjusting taxable income to include or exclude certain items:

- Additions: Business interest expense, net operating loss deductions, qualified business income deductions, and depreciation (for years before 2022).

- Subtractions: Business interest income, floor plan financing interest, and any income not allocable to non-excepted trades or businesses.

For tax years beginning after 2021, depreciation, amortization, or depletion deductions are no longer added back to taxable income in calculating ATI, making it important to adjust calculations accordingly.

Business Interest Expense and Income

Business interest expense is any interest expense attributable to a trade or business that is not excepted under Section 163(j). In contrast, business interest income refers to interest income that is includable in gross income and is similarly attributable to a non-exempt trade or business.

Understanding the correct classification of interest income and interest expense ensures compliance with Treasury Regulations §1.163(j)-1(b)(22), which details the components of interest for the purpose of these calculations.

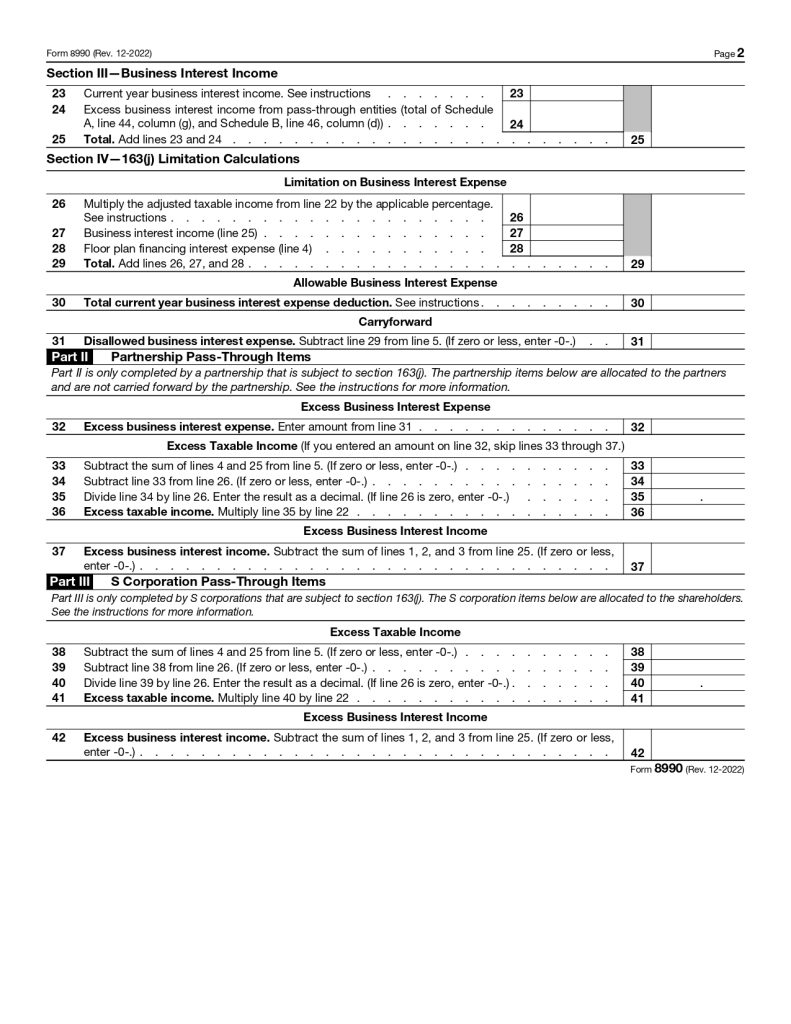

How Does Section 163(j) Apply to Partnerships?

For partnerships, the Section 163(j) limitation is determined at the partnership level. Any disallowed business interest expense is allocated to partners as excess business interest expense (EBIE), which they can carry forward to future years.

In subsequent years, partners can use EBIE against excess taxable income or excess business interest income from the same partnership, adjusting their adjusted taxable income and maximizing interest deductions.

For S corporations, any disallowed business interest expense remains at the corporate level and is carried forward to succeeding tax years.

Impact of the CARES Act on Partnerships

The CARES Act provided additional relief by allowing partners to treat 50% of their allocable share of a partnership’s 2019 EBIE as a deduction for 2020 without limitations. This provision was especially beneficial for businesses facing challenges during the pandemic.

What is Floor Plan Financing Interest?

Floor plan financing interest expense is the interest paid on financing used for acquiring motor vehicles held for sale or lease. It is critical for automobile dealerships and similar businesses.

Unlike other types of business interest, floor plan financing interest expense is always deductible under Section 163(j), making it an essential consideration for eligible businesses.

If you’re looking for expert assistance with your bookkeeping, EduEasify KPO is here to help. We can guide you through the process of recording your entire financial history in a well-organized manner, freeing you up to focus on what truly matters: growing your business.

What Happens to Disallowed Business Interest Expense?

If a business’s interest expense exceeds the Section 163(j) limitation, the disallowed business interest expense is not lost but is carried forward to subsequent years.

This carryforward can be used in future tax years when the Section 163(j) limitation allows for additional deductions, providing flexibility for businesses managing their interest deductions over time.

Download Form 8990

Bottom Line

Understanding Form 8990 and the Section 163(j) limitation is vital for businesses aiming to maximize their interest expense deductions. With various exemptions, elections, and special rules, careful planning and proper compliance with Treasury Regulations are essential for minimizing tax liabilities and aligning with IRS requirements. By staying informed about CARES Act provisions and adjustments to ATI calculations, businesses can ensure they make the most of available tax benefits and optimize their financial outcomes.

By following these guidelines, taxpayers can accurately complete Form 8990 and make informed decisions regarding their business interest expense deductions, allowing for smoother tax filing and better financial management.

Get the Latest Financial News, Expert Insights, Trends, and Tips you need to make Informed Decisions about your Business, Taxes, and Investments at edueasify.