Child Tax Credit 2024 Update: The Child Tax Credit remains a crucial financial lifeline for many families across the US. As we navigate tax season in 2024, understanding the current landscape and upcoming changes is essential for maximizing your benefit. Here’s a deep dive into the latest updates and key information families need to know about the Child Tax Credit.

What Is the Child Tax Credit?

The Child Tax Credit is a tax benefit provided to American taxpayers who have children under the age of 17 at the close of the tax year. In the 2023 tax year (for the tax return filed in 2024), the credit amounts to $2,000 for each eligible child.

To receive the full credit for each child, an individual filer must have an income of up to $200,000, while joint filers can earn up to $400,000. However, the credit gradually decreases for parents with higher incomes and eventually phases out.

Who Qualifies for Child Tax Credit ?

The Child Tax Credit (CTC) is a valuable financial benefit for eligible parents and guardians, designed to provide assistance in raising children. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States.

Understanding the criteria and requirements for claiming this credit is crucial for maximizing its benefits. In this blog post, we will delve into the details of the CTC for the 2023 tax year, shedding light on eligibility factors and income thresholds.

Eligibility Criteria for a Qualifying Child

To claim the CTC for the 2023 tax year, your dependent must meet the following criteria:

- Age Requirement: The child must be under the age of 17 at the end of the tax year.

- Relationship Qualification: The qualifying child can be your son, daughter, stepchild, eligible foster child, brother, sister, stepbrother, stepsister, half-brother, half-sister, or a descendant of one of these (e.g., grandchild, niece, or nephew).

- Financial Support: The child should not provide more than half of their own financial support during the year.

- Residency: The child must have lived with you for more than half of the tax year.

- Dependent Claim: You must be able to claim the child as a dependent on your tax return.

- Filing Status: The child should not file a joint return with their spouse, except to claim a refund of withheld income tax or estimated tax paid.

- Citizenship Status: The child must have been a U.S. citizen, U.S. national, or U.S. resident alien.

Income Thresholds

To qualify for the full amount of the 2023 Child Tax Credit, you must meet specific income criteria. The full credit is available if your annual income is not more than $200,000 ($400,000 for those filing a joint return).

Partial Credit for Higher Incomes

Parents and guardians with incomes exceeding the threshold may still be eligible for a partial credit. This ensures that a broader range of families can benefit from the CTC, albeit to a reduced extent.

How to Claim the Child Tax Credit

To claim the Child Tax Credit, eligible taxpayers must follow these steps:

- File Form 1040:

- Start by completing Form 1040 (U.S. Individual Income Tax Return), the standard tax form for reporting your income to the Internal Revenue Service (IRS).

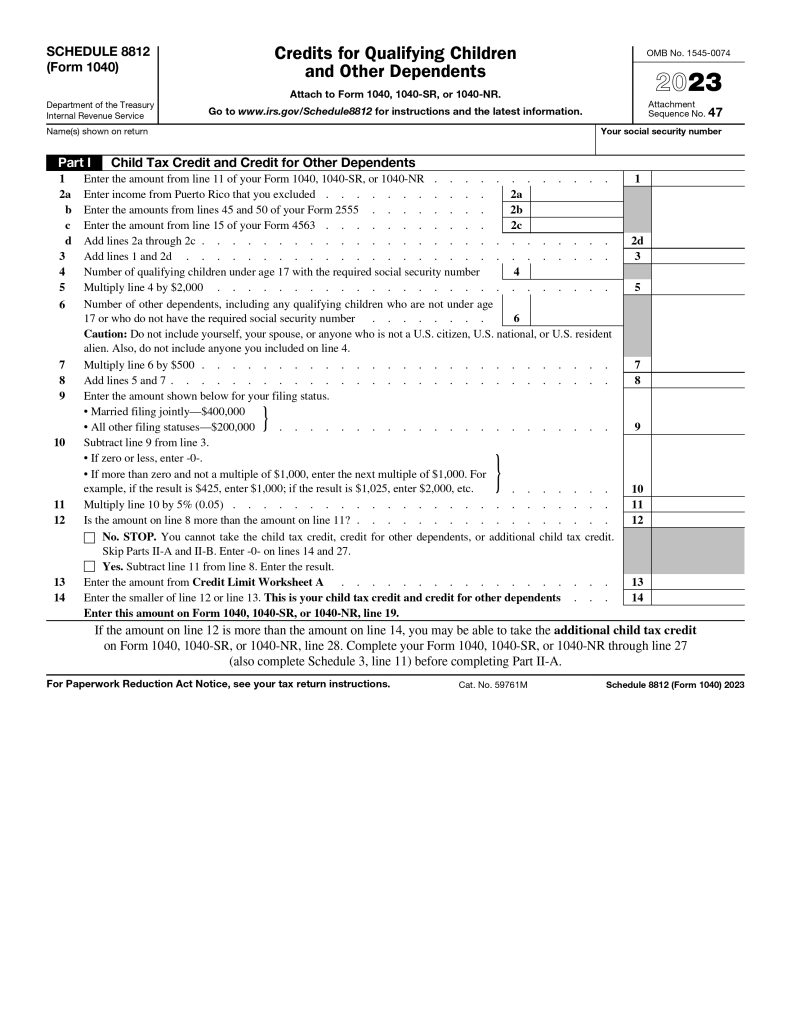

- Attach Schedule 8812:

- Along with Form 1040, taxpayers must attach Schedule 8812 (Credits for Qualifying Children and Other Dependents). This schedule is specifically designed to calculate the amount of Child Tax Credit the taxpayer is entitled to.

- Provide Necessary Information:

- When filling out Schedule 8812, ensure that you provide all the necessary information about your qualifying children and dependents. This may include their names, Social Security numbers, relationship to you, and other relevant details.

- Calculate Child Tax Credit:

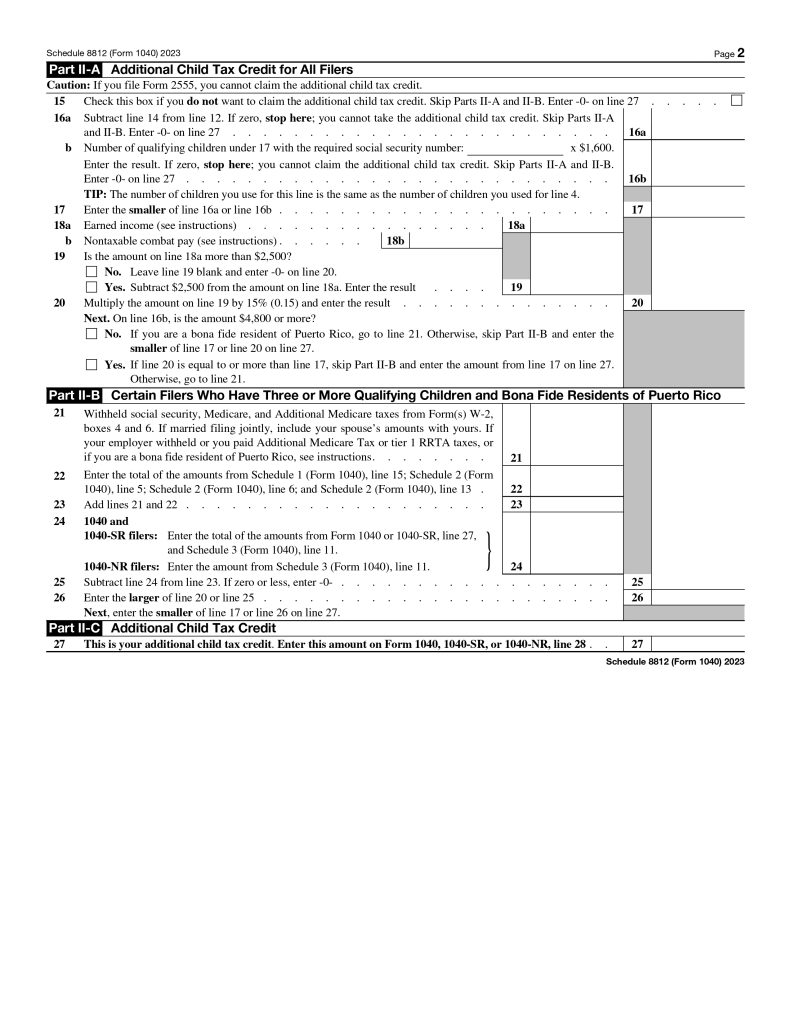

- Use Schedule 8812 to determine the amount of Child Tax Credit you are eligible to receive. This credit can be partially refundable when combined with the Additional Child Tax Credit, allowing you to receive a portion of it back even if you don’t owe any taxes.

- Submit the Documents:

- Once both Form 1040 and Schedule 8812 are completed, submit them to the IRS as part of your tax return. Ensure that all required documentation is accurate and attached to avoid any delays or issues.

- Review Eligibility Criteria:

- Before claiming the Child Tax Credit, make sure you meet the eligibility criteria. The credit is often available to families with qualifying children, and the amount may vary based on factors such as income, filing status, and the number of dependents.

- Consider Other Refundable Credits:

- Explore other refundable credits, such as the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC), as mentioned by the IRS. Understanding and claiming all eligible credits can maximize your potential tax refund.

By following these steps and accurately completing the required forms, eligible taxpayers can claim the Child Tax Credit and potentially receive a refund, even if they do not owe any taxes. It’s important to stay informed about tax credits and incentives to ensure you are taking advantage of all available benefits.

Schedule 8812 of Form 1040

You can Download the Schedule 8812 of Form 1040 by official website of IRS by click on the Link.

Child Tax Credits: Refundable Changes in 2023 and 2024

The Child Tax Credit (CTC) for the tax year 2023 remains at $2,000 per child or other dependent. While the CTC itself is nonrefundable, taxpayers can benefit from the partially refundable Additional Child Tax Credit (ACTC).

This means that even if a taxpayer doesn’t owe any income tax, they may receive a portion of the ACTC as a refund. In 2023, the refundable amount is up to $1,600, and this figure increases to $1,700 for the tax year 2024.

Also Read: Farming Finances 101: Your Quick Guide to Schedule F on Form 1040

KEY TAKEAWAYS

- The Child Tax Credit is a $2,000-per-child tax benefit claimed by filing Form 1040 and attaching Schedule 8812 to the return.

- To qualify for the credit, the taxpayer’s dependent must generally be under the age of 17 and must have a Social Security number.

- The full benefit is available to people whose income did not exceed $400,000 for joint filers, or $200,000 for single filers. It phases out at higher income levels.

- Up to $1,600 of the credit is refundable in the 2023 tax year, rising to $1,700 in 2024.

Frequently Asked Questions (FAQs) – Child Tax Credit Increase 2024

The Child Tax Credit is a tax benefit provided to American taxpayers with qualifying children under the age of 17. It’s designed to financially assist families in raising children. Understanding and claiming the CTC is crucial for maximizing benefits and alleviating childcare costs.

For the 2023 tax year (for the return filed in 2024), the Child Tax Credit amounts to $2,000 for each eligible child.

To qualify, you must meet criteria such as having a qualifying child with a valid Social Security number, meeting income thresholds, and fulfilling eligibility requirements detailed in the IRS guidelines.

To claim the CTC for the 2023 tax year, the child must be under 17, have a valid Social Security number, not provide more than half of their financial support, live with you for more than half of the tax year, and meet other specified criteria.

The full credit is available if your annual income is not more than $200,000 (or $400,000 for joint filers). There’s a partial credit for incomes exceeding these thresholds, ensuring a broader range of families can benefit.

To claim the CTC, follow these steps:

01. File Form 1040 (U.S. Individual Income Tax Return).

02. Attach Schedule 8812 (Credits for Qualifying Children and Other Dependents).

03. Provide necessary information about your qualifying children on Schedule 8812.

04. Use Schedule 8812 to calculate the amount of Child Tax Credit.

05. Submit completed forms to the IRS as part of your tax return.

The Child Tax Credit is partially refundable. When combined with the Additional Child Tax Credit, eligible taxpayers may receive a portion of the credit back as a refund, even if they don’t owe any taxes.

Explore other refundable credits like the Earned Income Tax Credit (EITC) and Additional Child Tax Credit (ACTC) to maximize your potential tax refund. Consult with a tax professional to ensure you’re claiming all eligible credits.

Reviewing eligibility criteria ensures that you meet all requirements for claiming the Child Tax Credit. Factors such as income, filing status, and the number of dependents can influence the credit amount.

Yes, tax laws can be complex. Consulting with a tax professional is advisable to ensure accurate and optimal claiming of the Child Tax Credit for the 2023 tax year. They can provide personalized guidance based on your specific financial situation.

Understanding the eligibility criteria and income thresholds for the Child Tax Credit is essential for parents and guardians seeking financial support in raising their children. By meeting these criteria, families can take advantage of this valuable tax benefit to help alleviate the costs associated with childcare.

As tax laws can be complex, it is advisable to consult with a tax professional to ensure accurate and optimal claiming of the Child Tax Credit for the 2023 tax year.

Get live Tax and Finance updates, US Business Tax and Bookkeeping, and the latest India & US News and business news on Edueasify.