Wyoming Sales & Use Tax: If your business is in Wyoming, just being registered there doesn’t mean you automatically need a sales/use tax license.

To collect or remit the Sales Taxes to the Wyoming Department of Revenue are wholly depends on whether you are a “Vendor” or not. if Yes, then you need to obtain a Sales/Use Tax License.

Are You a Vendor?

“Vendor” means any person engaged in the business of selling at retail or wholesale tangible personal property, admissions or services

which are subject to taxation under the Wyoming Sales Tax.

“Vendor” means any person engaged in the business of selling at retail or wholesale tangible personal property, having or maintaining within this state, directly or by any subsidiary, an office, distribution house, sales house, warehouse or other place of business, or any agents operating or soliciting sales or advertising within this state under the authority of the vendor or its subsidiary, regardless of whether the place of business or agent is located in the state permanently or temporarily or whether the vendor or subsidiary is qualified to do business within this state.

Who is Out of state vendors for Wyoming

Businesses located outside the state may be required to license for Wyoming sales tax purposes if they have created a physical or substantive economic presence in the state of Wyoming.

For example if the business directly or through a subsidiary

- Has an office, distribution house, sales house or warehouse or any other place of business located in the State of Wyoming;

- Has any persons operating, soliciting sales or advertising within the State of Wyoming’

- Has inventory or equipment located in the State of Wyoming.

- Leases equipment in the State of Wyoming; or

- Makes deliveries into the State of Wyoming in company vehicles.

Condition for Applicability of Sales tax in Wyoming

There are two basic Condition for Applicability of Sales tax in Wyoming. if you comply any of this condition then you must require a sales/use tax license in Wyoming.

- if the seller’s gross revenue from the sale of tangible personal property, admissions or services in Wyoming exceeds one hundred thousand dollars ($100,000) or

- if the seller makes two hundred (200) or more separate transactions for delivery in our state in the current calendar year or the immediately preceding calendar year.

Rate of Sales/Use Tax in Wyoming

In Wyoming, the use tax and sales tax rates are the same, currently set at 4% by the legislature.

Steps to Obtaining a Sales/Use tax license

Any person/business acting as a vendor is required to license for sales tax purposes in Wyoming. Two Mode for obtaining a sales/use tax license.

- Physical Mode

- Online Mode

Physical Mode

- Wyoming Sales/Use Tax License Application may be accessed and downloaded from http://revenue.wyo.gov.

- On the left of the main page, locate the column titled “Home”. In the Home column find “Excise (Sales & Use) Tax Division” > Select sub category “Forms” > Select “Sales and Use Tax License Applications Forms” > Select “Sales and Use Tax License Application”.

Click on the link to Download the Sample Sales and Use Tax License Application Form.

The application should be accompanied with a $60.00 non-refundable check for the licensing fee.

Online Mode

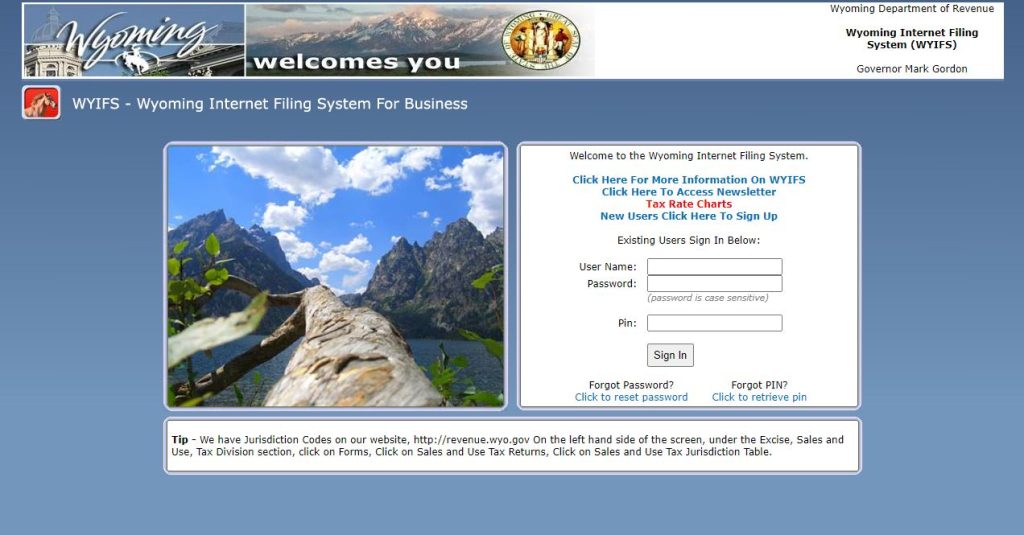

Alternatively, an application may be submitted online through our Wyoming Internet Filing Service (WYIFS) portal.

The first step in the process of applying online is to register the column titled “Home” > In the Home column find “Excise (Sales & Use) Tax Division” > Select sub category “Publications” > Select “Sales and Use Tax Publications for Specific Industries”

Sales Tax Reporting Frequency in Wyoming

The Department shall assign vendors a filing frequency at the time of licensing. Filing frequency may be changed by the Department based on the volume of sales/use tax collected and other criteria as established in policy and procedure guidelines.

Recently, Filing frequency assigned by the Department shall be

- Monthly,

- Quarterly or

- Annually

Vendors volunteering to collect Wyoming sales and use tax through the Streamlined Sales and Use Tax Agreement shall file at least on an annual basis or whenever the vendor has collected in excess of $1,000.

Form to be Filed for Sales Tax In Wyoming

Vendors shall file sales/use tax data on sales/use tax returns provided by the Department or in other format or media as approved by the Department.

Returns shall be rejected if not completed in accordance with the instructions provided.

A vendor shall have 15 calendar days from the date of notification to submit a corrected report without incurring late filing penalties, as long as the original report was filed on time.

Due date for Payment of Wyoming Sales Tax

- Monthly filers shall submit returns and tax on or before the last day of the month following the month in which the Wyoming sales occurred;

- Quarterly filers shall submit returns and tax on or before January 31, April 30, July 31, and October 31 of each calendar year; and

- Annual filers shall submit returns on or before January 31 of each calendar year.

If a due date falls on a weekend or federal or Wyoming state holiday, the next business day serves as the new due date.

Read More: Delaware LLC: 7 Top Benefits to Start Your Business

For More such Insightful helpful content, do join us on our Instagram Page-Edueasify. Get the Latest Information on Business, Finance, Investment, Brand Building, Lifestyle, Entertainment, and Billionaire Quotes On Edueasify.