Form 1099-NEC plays a critical role in U.S. tax compliance by ensuring accurate reporting of nonemployee compensation paid to independent contractors, freelancers, and other service providers. Businesses that pay $600 or more during a calendar year to nonemployees for services are generally required to report these payments to the IRS using Form 1099-NEC. Proper reporting helps the IRS track taxable income and prevents underreporting by recipients.

With the growing use of freelancers, consultants, and gig workers, an understanding of Form 1099-NEC and the reporting of nonemployee compensation has become essential for small businesses, startups, and accounting professionals. IRS penalties may be imposed if deadlines are missed, amounts are reported incorrectly, or workers are misclassified. This guide explains who is required to file Form 1099-NEC, which payments are reportable, applicable filing deadlines, and common mistakes that should be avoided to remain compliant.

Form 1099-NEC and Reporting Nonemployee Compensation

| Particulars | Details |

|---|---|

| Form Name | Form 1099-NEC |

| Purpose | Reports nonemployee compensation paid to independent contractors |

| Who Must File | Businesses, sole proprietors, partnerships, and corporations making qualifying payments |

| Payment Threshold | $600 or more during the calendar year |

| Who Receives It | Independent contractors, freelancers, consultants, service providers |

| Type of Payments Reported | Professional fees, commissions, consulting fees, contract labor |

| Box Used on Form | Box 1 – Nonemployee Compensation |

| Payments Excluded | Employee wages, personal payments, merchandise purchases |

| Filing Deadline | January 31 (to IRS and recipient) |

| Electronic Filing Required | Yes, if filing 10 or more information returns |

| Penalties for Late Filing | Monetary penalties based on delay and intent |

| Backup Withholding Applicable | Yes, at 24% if required |

| IRS Authority | Internal Revenue Service (IRS) |

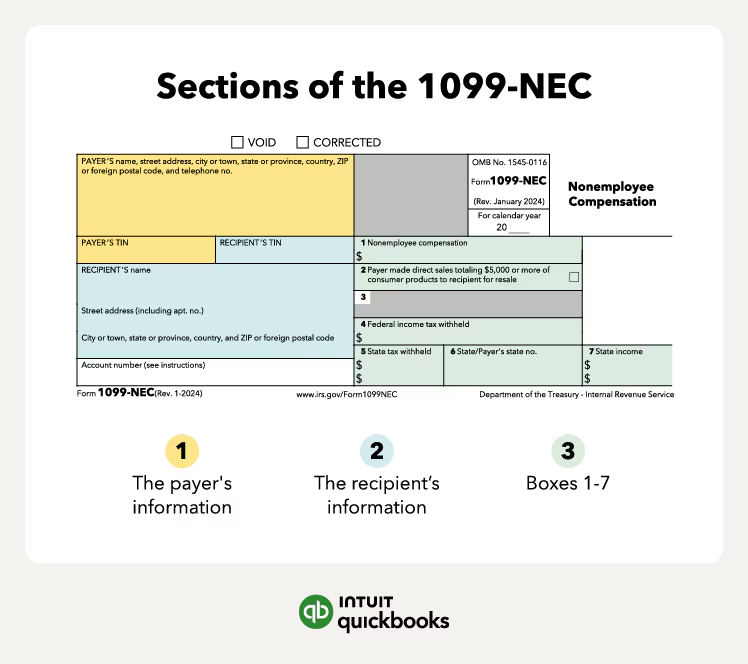

A visual breakdown of the key sections of Form 1099-NEC is provided in the image above to help businesses and taxpayers understand how nonemployee compensation is reported to the IRS. Form 1099-NEC is divided into three main areas: the payer’s information, the recipient’s information, and Boxes 1 through 7, where payment and tax details are reported. This structured layout ensures accurate identification of both parties and proper reporting of compensation paid to independent contractors and service providers.

By clearly separating payer details, recipient details, and reportable amounts, errors are reduced and compliance with IRS reporting requirements is improved. An understanding of these sections is essential for the correct completion of Form 1099-NEC, the avoidance of mismatches, and the prevention of penalties related to incorrect or incomplete reporting of nonemployee compensation.

Form 1099-NEC is used to report nonemployee compensation that is paid during the year to independent contractors, freelancers, and other self-employed individuals.

Key IRS Differences in Reporting Nonemployee Compensation

| Area | IRS Requirement | Practical Difference / IRS Clarification |

|---|---|---|

| Reporting Form | Form 1099-NEC | Replaced Box 7 of Form 1099-MISC (from 2020) |

| Payment Threshold | $600 | Applies per payee, per year |

| Payment Method | Cash, check, ACH, wire | Credit card & third-party payments excluded |

| Third-Party Payments | Not reported on 1099-NEC | Reported by processor on Form 1099-K |

| Corporations | Generally exempt | Attorneys must still be reported |

| Filing Deadline | January 31 | Same deadline for IRS and recipient copies |

| Electronic Filing | Required at 10+ forms | IRS mandates e-filing threshold |

Form 1099-NEC is used to report nonemployee compensation that is paid during the tax year to independent contractors, freelancers, and other self-employed individuals by U.S. businesses. While the reporting rules are administered and enforced by the IRS, practical differences often arise between what is required to be reported by the IRS and how payments are actually made by businesses.

According to IRS guidance, nonemployee compensation is generally considered to include fees paid to independent contractors and consultants, professional service payments (legal, accounting, IT, and marketing), commissions, bonuses, and incentive payments, as well as director fees paid to non-employees. These amounts are reported in Box 1 of Form 1099-NEC when total payments of $600 or more are made during a calendar year.

Form 1099-NEC and Reporting Nonemployee Compensation AND IRS HOW ARE THE SAME?

Here is a clear explanation of how IRS, Form 1099-NEC, and reporting nonemployee compensation are related and where overlap or differences are found:

1. IRS

- The Internal Revenue Service (IRS) is the U.S. government agency responsible for tax collection and enforcement.

- The rules for reporting income, including nonemployee compensation, are set by the IRS.

- Payments are not made, nor forms issued by the IRS—it enforces compliance.

2. Form 1099-NEC

- Form 1099-NEC is the official IRS form used by businesses to report payments made to nonemployees (contractors, freelancers, consultants).

- It is a tool used to comply with IRS rules, rather than being the rule itself.

- Nonemployee compensation of $600 or more in a tax year is reported in Box 1.

3. Reporting Nonemployee Compensation

- Reporting of nonemployee compensation is the act by which payments made to independent contractors are documented and sent to the IRS (using Form 1099-NEC).

- The requirement is mandated, while Form 1099-NEC is the method by which the requirement is fulfilled.

Payments Reported on Form 1099-NEC :

- Professional fees

- Consulting fees

- Contract labor

- Freelance services

- Commissions paid to non-employees

- Director fees

- Fees paid to attorneys (even if incorporated)

read more: https://edueasify.com/irs-2026-tax-season-challenges/

conclusion

Form 1099-NEC plays a critical role in ensuring accurate reporting of nonemployee compensation and maintaining IRS compliance. If your business pays $600 or more to independent contractors, freelancers, or other nonemployees during the year, issuing Form 1099-NEC is not optional—it’s a legal requirement.

In short, understanding and correctly reporting nonemployee compensation using Form 1099-NEC is a small step that prevents big compliance issues. Staying proactive, organized, and informed will keep your business on the right side of IRS reporting requirements.

Get the Latest Financial News, Expert Insights, Trends, and Tips you need to make Informed Decisions about your Business, Taxes, and Investments at edueasify.