Social Security Payment Schedule: Millions of Social Security beneficiaries in the United States are eagerly awaiting their monthly payments this November. For many, this financial assistance is an important lifeline that helps them meet day-to-day expenses. This week, a special group of retirees, Group 3, will receive their payments, marking an important date for those with birthdays between the 11th and 20th of the month.

If you are a recipient of Social Security benefits, understanding the payment schedule and eligibility criteria can help you better plan your finances.

Here’s what you need to know about this month’s Social Security payments, eligibility requirements and maximum benefits.

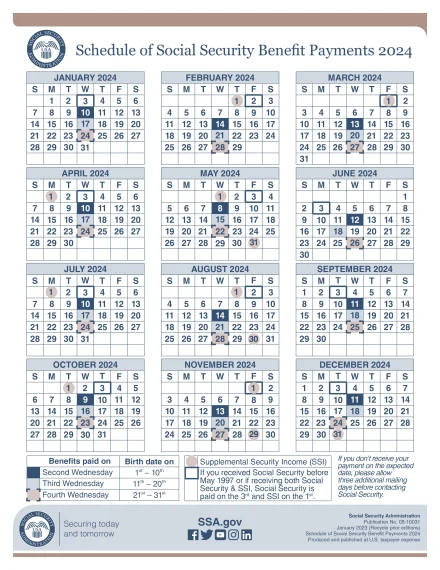

Social Security Payment Dates 2024

November 2024 sees multiple important payment dates for Social Security and Supplemental Security Income (SSI) beneficiaries.

| Payment Group | Payment Date | Details |

|---|---|---|

| Survivors, disabled individuals, and retirees | November 1, 2024 | Beneficiaries who started receiving payments before May 1997. |

| Group 1: Birthdays between 1st and 10th | November 13, 2024 | Payments issued on the second Wednesday of the month. |

| Group 2: Birthdays between 11th and 20th | November 20, 2024 | Payments issued on the third Wednesday of the month. |

| Group 3: Birthdays between 21st and 31st | November 27, 2024 | Final Social Security payment for retirees in November. |

| SSI Recipients (December payment in advance) | November 29, 2024 | SSI for December issued early due to the first falling on a Sunday. |

Schedule of Social Security Benefit Payments 2024

Eligibility for Social Security Payment 2024

To receive the November 20 payment, retirees must meet the following conditions.

- 👉🏼 Start of benefits: You must have started receiving benefits after May 1997.

- 👉🏼 Birthday Range: Your birthday should be between 11th and 20th of any month.

This deferred payment system ensures efficient delivery and avoids overloading the payment processing system. Beneficiaries in this group benefit and receive their checks earlier, which helps in better financial planning.

- Social Security Increase 2025: How a 2.5% COLA Could Impact Your Budget

- Social Security Benefits Expansion Bill: What It Means for Pensions and Next Steps in Congress

- Best Retirement Planning Tips for 2025: A Step-by-Step Guide

- Best Retirement Planning Tips for 2025: A Step-by-Step Guide

- IRS Raises Healthcare FSA 2025 Contribution Limit to $3300

Supplemental Security Income (SSI) payments

For SSI recipients, November includes payments beginning in December on November 29, 2024.

Usually issued on the first day of every month, this arrangement ensures that beneficiaries receive their money before the weekend.

Maximum Social Security Benefits for 2024

Although most beneficiaries receive an average monthly payment of $1,873, the maximum amount varies based on retirement age and work history.

| Retirement Age | Maximum Monthly Benefit |

|---|---|

| Early Retirement (62) | $2,710 |

| Full Retirement (67) | $3,822 |

| Delayed Retirement (70) | $4,873 |

Factors that affect your profit include:

- 👉🏼Earnings History: Average earnings for your 35 highest earning years.

- 👉🏼Retirement Age: Late payments on benefits increase.

Important Considerations for Beneficiaries of Social Security 2024

- Direct Deposit Advantage: Opting for Direct Deposit ensures that you receive your payment on the specified date.

- Earnings limit: Exceeding the annual limit of $22,320 for retirees below full retirement age in 2024 is reduced by $1 for every $2 earned over the limit.

Steps to Apply for Social Security Benefits

If you’re nearing retirement or eligible for Social Security, here’s how to apply.

👉🏼 Online : Visit the official website of Social Security Administration (SSA).

👉🏼 Telephone: Call SSA to schedule an appointment or submit your application.

👉🏼 In person: Go to your nearest Social Security office with the required documents.

Tips for managing your Social Security Benefits

- Plan a monthly budget: Knowing your payment dates can help you allocate money for necessities like rent, utilities, and groceries.

- Review Eligibility Annually: Stay up-to-date on changes in eligibility criteria or benefit adjustments.

- Consult with financial advisors: Explore investment options like IRAs or savings plans to maximize your benefits.

Get the Latest Financial News, Expert Insights, Trends, and Tips you need to make Informed Decisions about your Business, Taxes, and Investments at edueasify.