Tax Tips for Farmers: Unveiling the Secrets of Schedule F: “Farming Finances 101: Your Quick Guide to Schedule F on Form 1040” – your go-to resource for unlocking financial clarity in the world of agriculture.

In this comprehensive guide, we’ve distilled the essentials to navigate the intricate landscape of Schedule F on Form 1040, empowering farmers with the knowledge to manage their finances effortlessly.

Join us on this journey as we demystify the intricacies of Schedule F, providing you with practical insights to streamline your farming finances.

Quick Guide to Schedule F on Form 1040

Navigating the complexities of tax forms is crucial for IRS compliance. One key element of Form 1040 that demands attention is Schedule F, particularly significant for specific taxpayers.

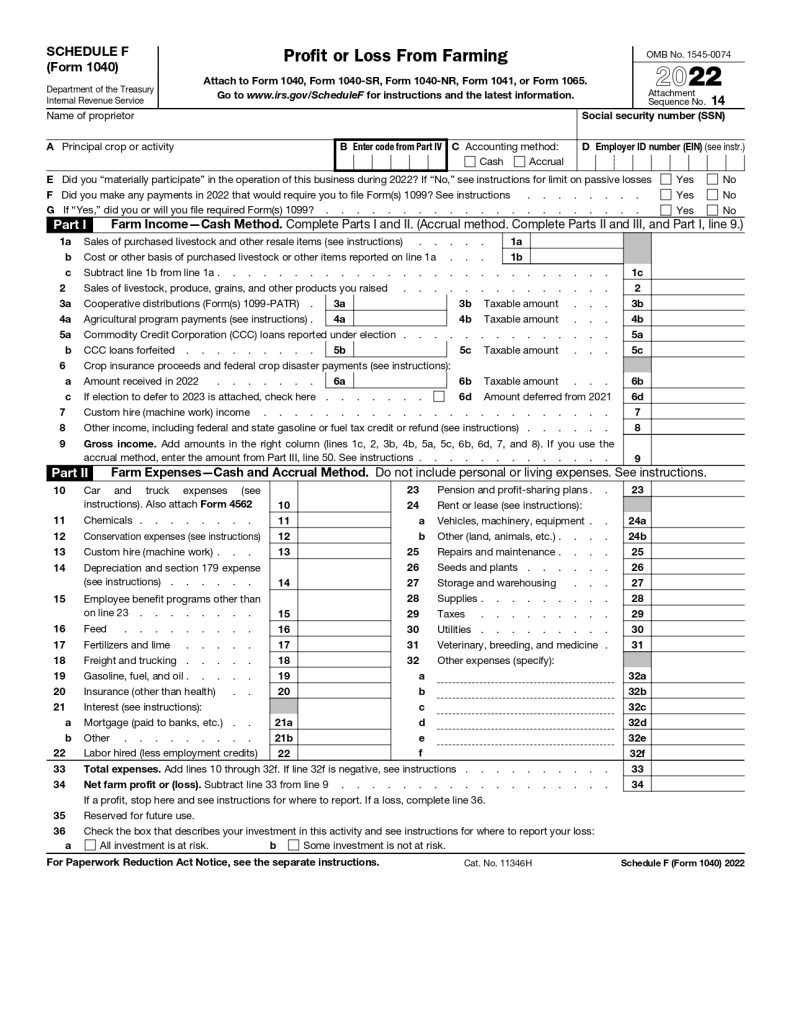

Use Schedule F (Form 1040) to report farm income and expenses. File it with Form 1040, 1040-SR, 1040-NR, 1041, or 1065.

Let’s break down Schedule F and explore its implications.

1. Understanding Schedule F

Schedule F is a supplementary form that accompanies Form 1040, specifically tailored for individuals and businesses engaged in farming and ranching activities.

Its primary objective is to meticulously document and report financial transactions associated with agricultural pursuits.

2. Applicability of Schedule F

This form is mandatory for those directly involved in farming operations, including cultivation, ranching, livestock raising, and other related agricultural activities.

Whether farming is your primary occupation or a supplementary source of income, Schedule F is an integral part of your tax filing obligations.

3. Income and Expenditure Reporting

On Schedule F, filers are required to delineate their gross income from farming operations.

This encompasses revenue generated from the sale of crops, livestock, and other agricultural products. Concurrently, it necessitates a comprehensive breakdown of deductible expenses, such as seed and fertilizer costs, equipment depreciation, and labor expenditures.

The resultant net income or loss significantly influences overall tax liability.

Farm Expenses

Following are the list of Farm Expenses which are Don’t deductible while Filling the Schedule F.

- Personal or living expenses (such as taxes, insurance, or repairs on your home) that don’t produce farm income.

- Expenses of raising anything you or your family used.

- The value of animals you raised that died.

- Inventory losses.

- Personal losses.

If you were repaid for any part of an expense during the same year, you must subtract the amount you were repaid from the deduction.

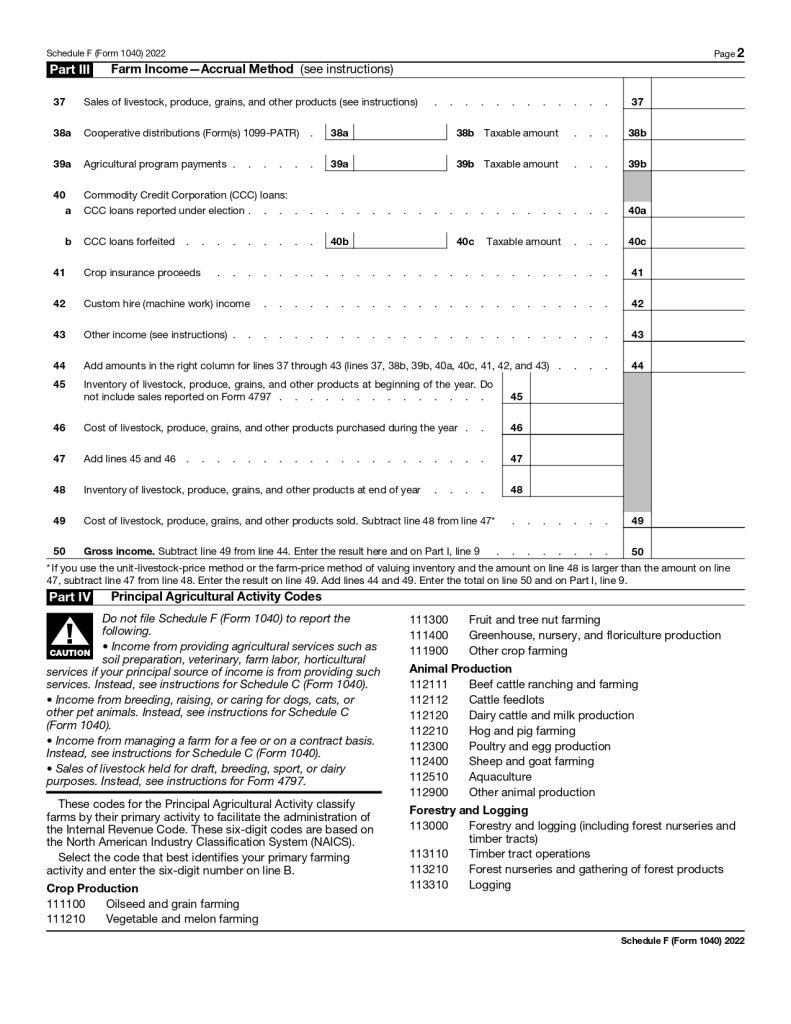

Farm Income—Accrual Method

You may be required to use the accrual method of accounting. If you use the accrual method, report farm income when you

earn it, not when you receive it.

In most cases, you must include animals and crops in your inventory if you use this method.

4. Special Considerations for Farmers

Farmers encounter distinct tax provisions, among which income averaging holds prominence.

This mechanism enables farmers to level out income fluctuations over a span of three years, contributing to a more stabilized financial landscape.

5. Overview of Income Averaging

Incorporating income averaging involves the calculation of an average taxable income derived from the current tax year and the two preceding years.

This strategy proves advantageous in mitigating the impact of substantial income fluctuations, characteristic of the agricultural sector due to factors such as varying harvest yields and market conditions.

Read: What Is Form 1095-C?

6. Filing Recommendations for Schedule F

Maintaining meticulous records of all income and expenditures, inclusive of receipts and invoices, is imperative for accurate reporting.

Leveraging accounting software or consulting with a tax professional facilitates enhanced precision and expedites the filing process.

Also Read: What are the 401(K) Contribution Limits for 2024 in the USA?

Schedule F on Form 1040

In summary, Schedule F serves as an indispensable component of Form 1040 for individuals involved in farming and ranching.

By gaining a comprehensive understanding of its intricacies and adhering to stipulated filing requirements, agricultural professionals ensure compliance with tax regulations while optimizing financial reporting.

To download Schedule F, simply click on the link provided below. Download Schedule F Form

Get the Latest Information on Business, Finance, Investment, Brand Building, Lifestyle, Entertainment, and Billionaire Quotes On Edueasify.