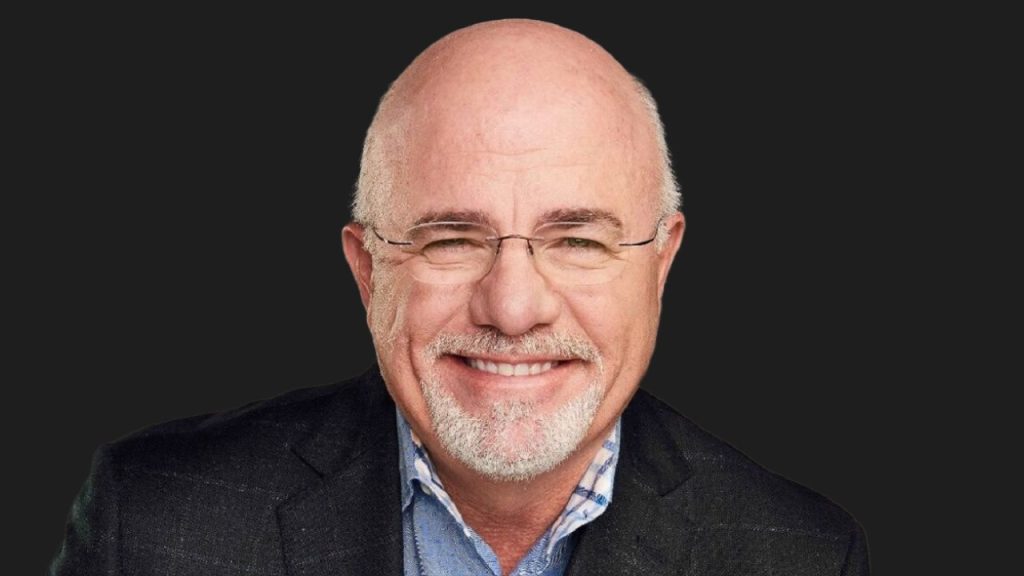

Dave Ramsey’s 8 Tips for Saving Money and Keeping a Budget: Financial steadiness and safety are fundamental for a stress-free life. Dave Ramsey, a famend economic guru, has laid out eight critical pointers that can assist you shop cash and continue to be on song with your budget. we will dive into every tip and discover how you can observe them to enhance your economic situation.

Dave Ramsey’s 8 Tips for Saving Money and Sticking to a Budget

Do you want to save money and stick to a budget? Dave Ramsey, a renowned financial guru, has laid out 8 essential tips that can help you achieve your financial goals.

In this blog post, we will dive into each tip and explore how you can apply them to your own life.

Tip 1: Create a Finances and Track your Spending.

To take manage of your finances, begin by using developing a budget. List all your profits sources and smash down your charges into classes such as housing, transportation, groceries, etc.

Tracking your spending will assist you discover areas where you can reduce lower back and shop extra money.

Tip 2: Cut again on useless Expenses

Evaluate your price range and perceive non-essential fees that you can cast off or reduce. For example, reflect onconsideration on cooking at domestic as a substitute of eating out frequently, or cancel unused subscription services.

Small adjustments can add up to massive financial savings over time.

Tip 3: Make Saving automatic

Automate your financial savings with the aid of placing up a direct savings to a separate financial savings account. When you deal with saving as a priority, you will be much less tempted to spend cash impulsively.

Aim to keep a share of your earnings every month, and watch your financial savings develop steadily.

Tip 4: Pay Yourself First

When you obtain your paycheck, allocate a component of it to your financial savings earlier than some thing else. Treat your financial savings as a non-negotiable expense, simply like paying bills.

Prioritizing your financial savings will make certain that you have money set apart for emergencies and future goals.

Tip 5: Live below your Means

Avoid the entice of life-style inflation. Instead of spending each greenback you earn, attempt to stay on much less than what you make. By retaining your costs decrease than your income, you will have extra cash to shop and make investments for the future.

Tip 6: Use Coupons and Discounts

Always be on the lookout for coupons, deals, and reductions when purchasing for groceries, clothing, or different necessities. This frugal method can lead to large financial savings besides sacrificing the fantastic of your purchases.

Tip 7: Shop round for the Great Deals

Before making any substantial purchases, take the time to evaluate fees and lookup unique options. Look for sales, negotiate expenditures when possible, and keep away from impulse buying. Being a savvy client can store you a extensive quantity of cash in the lengthy run.

Tip 8: Be Patient and Persistent

Achieving economic steadiness takes time and discipline. Be affected person with your self and remain dedicated to your economic goals.

There may additionally be challenges alongside the way, however by using staying persistent, you will construct true cash habits that will serve you nicely in the future.

Check: Secure Your Future: Why Investment is the Key to Financial Stability

Dave Ramsey’s eight recommendations for saving cash and sticking to a finances furnish realistic and actionable recommendation for everyone searching for economic freedom.

By developing a budget, reducing returned on expenses, automating savings, and practising patience, you can take manipulate of your monetary future.

Start imposing these hints today, and you will be on your way to a extra impenetrable and affluent monetary life. Remember, it is by no means too late to begin saving and constructing a higher economic future for yourself.

Get The Latest Information On Business, Finance, Investment, Brand Building, Lifestyle, Entertainment, And Billionaire Quotes On Edueasify.